Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. Unlike traditional currencies like the U.S. Dollar or Euro, cryptocurrencies operate on decentralized platforms, primarily using blockchain technology. But what does this all mean? Let’s break it down.

At its core, cryptocurrency is an innovative form of digital currency designed to function independently of any central authority, such as a government or financial institution. The most well-known cryptocurrency is Bitcoin, which was created in 2009 by an anonymous figure (or group) known as Satoshi Nakamoto. Since then, thousands of other digital currencies—altcoins—have been developed.

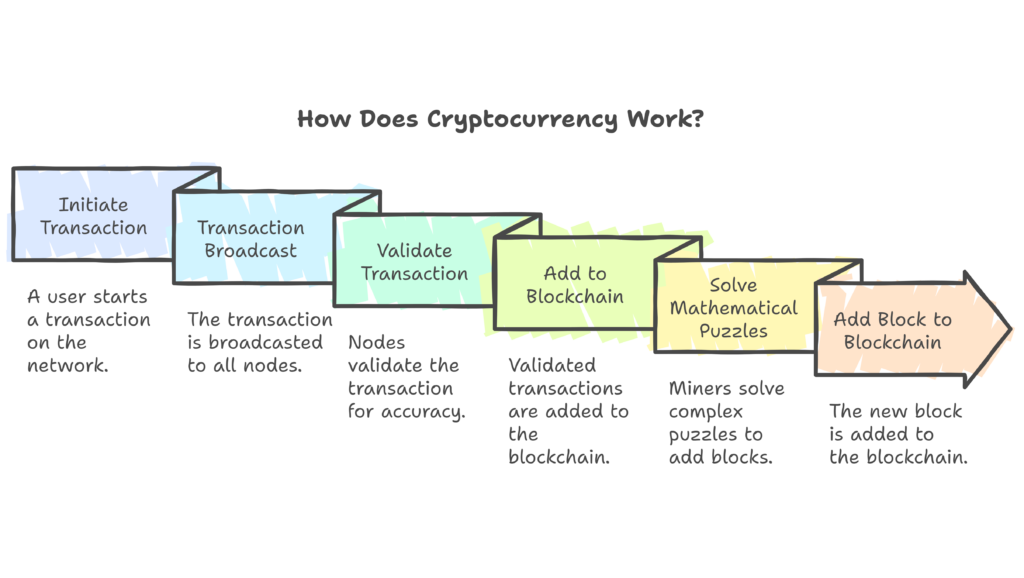

How Does Cryptocurrency Work?

Cryptocurrency operates on a decentralized network of computers called nodes. These nodes validate transactions and store information in a public ledger known as a blockchain. Blockchain technology ensures transparency, security, and trust, making it nearly impossible to alter past transaction records.

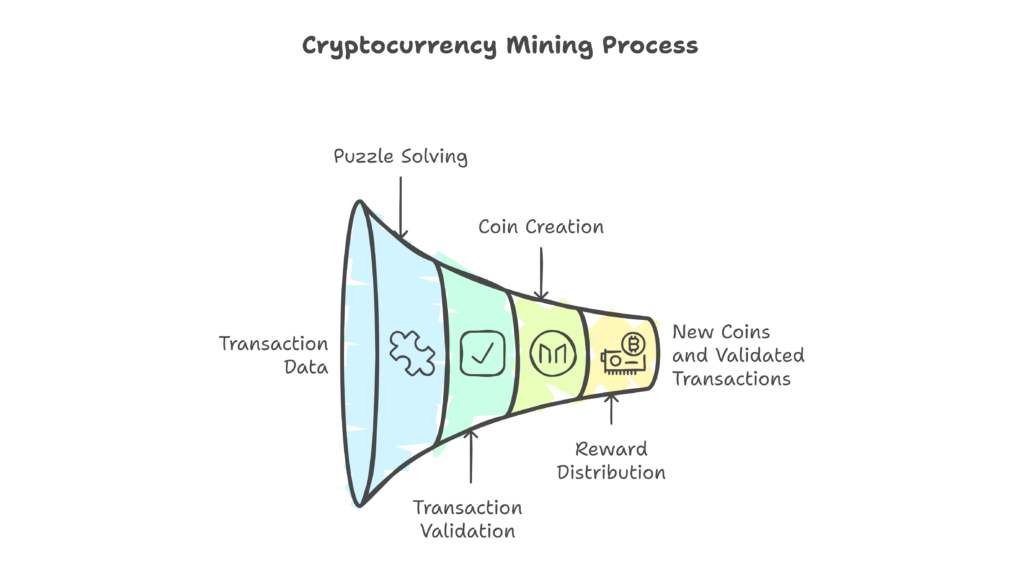

The process of mining is a way to verify transactions on the blockchain. Miners use powerful computers to solve complex mathematical puzzles and add blocks to the blockchain. In return, they are rewarded with new units of cryptocurrency.

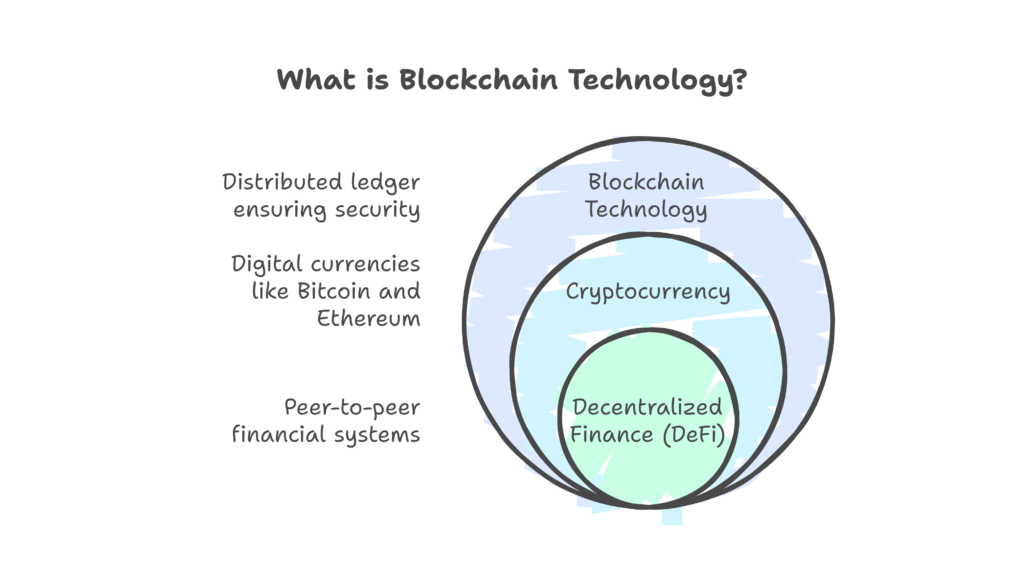

What is Blockchain Technology?

To understand cryptocurrency, it’s crucial to know about blockchain technology. Blockchain is a distributed ledger technology that records transactions across many computers in such a way that the registered transactions cannot be altered retroactively. Each transaction is recorded in a “block,” and these blocks are linked together in a chain (hence the term blockchain).

The security and decentralization of the blockchain are what make cryptocurrencies like Bitcoin and Ethereum so appealing. Blockchain allows peer-to-peer transactions without the need for a trusted third party (like a bank), which is why it’s often referred to as decentralized finance (DeFi).

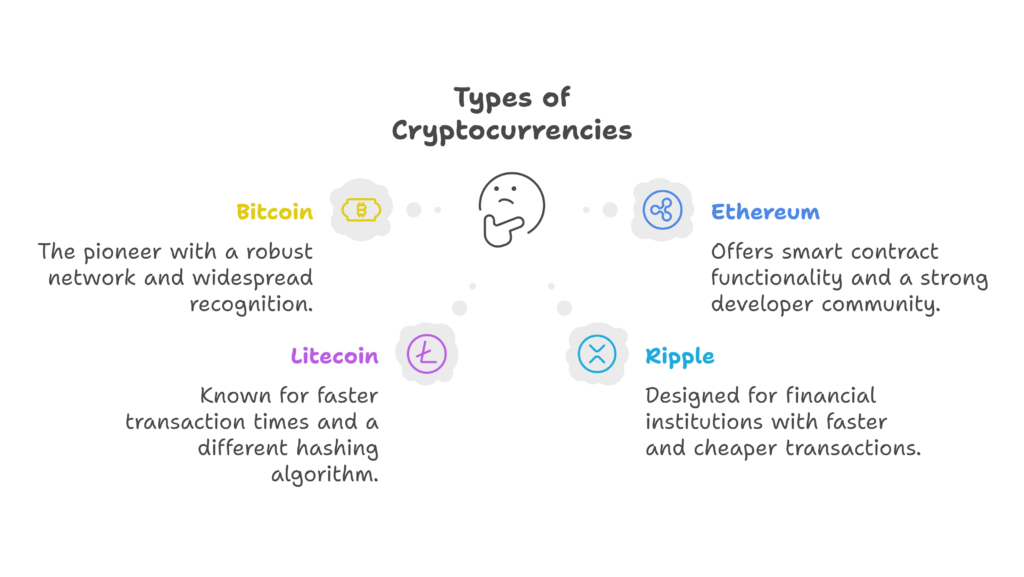

Types of Cryptocurrencies

While Bitcoin is the pioneer of cryptocurrency, there are many other digital currencies known as altcoins. These include well-known names like Ethereum, Litecoin, and Ripple (XRP). Each cryptocurrency operates on its own blockchain or utilizes a fork of another blockchain (for example, Bitcoin Cash is a fork of Bitcoin).

- Bitcoin (BTC): The first and most well-known cryptocurrency, Bitcoin operates on the Proof of Work (PoW) mechanism, which requires miners to solve complex problems to validate transactions.

- Ethereum (ETH): Ethereum allows not only for cryptocurrency transactions but also for the creation of smart contracts. These are self-executing contracts with the terms directly written into code.

- Ripple (XRP): Ripple is designed for financial institutions and is faster and cheaper than Bitcoin for transactions.

- Litecoin (LTC): Often referred to as the silver to Bitcoin’s gold, Litecoin offers faster transaction times and a different hashing algorithm.

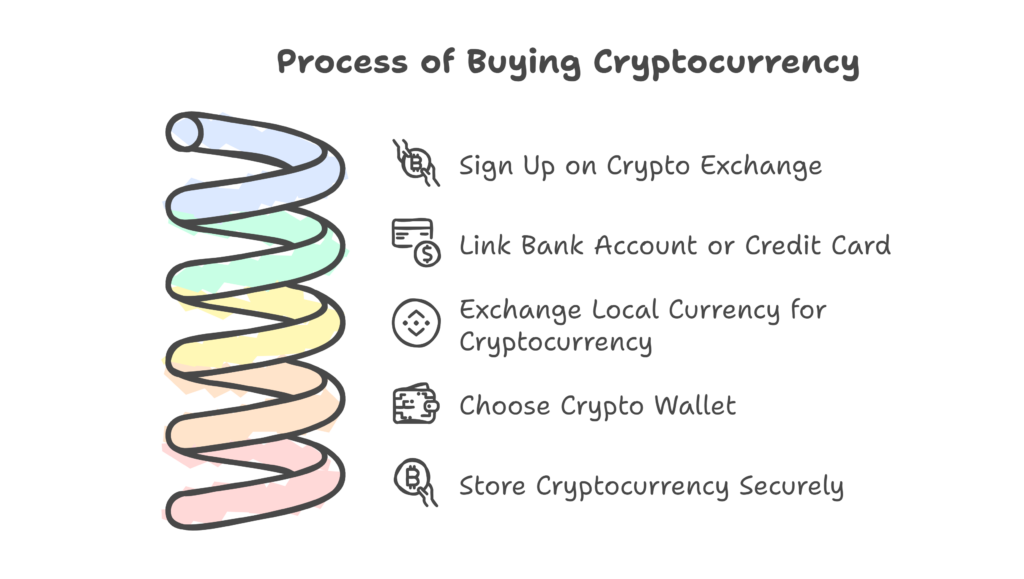

How Do You Buy Cryptocurrency?

Buying cryptocurrency is easy, but it requires careful consideration. To buy digital currencies like Bitcoin, Ethereum, or Litecoin, you’ll need to sign up on a crypto exchange such as Coinbase, Binance, or Kraken.

Once you have registered, you can link your bank account or credit card to fund your purchases. Afterward, you can exchange your local currency (USD, EUR, etc.) for cryptocurrency.

If you want to hold your cryptocurrency securely, you’ll need a crypto wallet. These wallets store your private keys (which you use to access your coins). There are two main types of wallets: hot wallets (software-based, connected to the internet) and cold wallets (hardware-based, offline).

What is Cryptocurrency Mining?

Cryptocurrency mining is the process by which new coins or tokens are created, and transactions are validated. Miners use high-powered computers to solve cryptographic puzzles that ensure the accuracy of transactions on the blockchain. As a reward for their work, miners are compensated with newly minted coins.

Not all cryptocurrencies require mining. For example, Ethereum is transitioning from Proof of Work to Proof of Stake (PoS), which is more energy-efficient and does not require miners.

The Risks and Challenges of Cryptocurrency

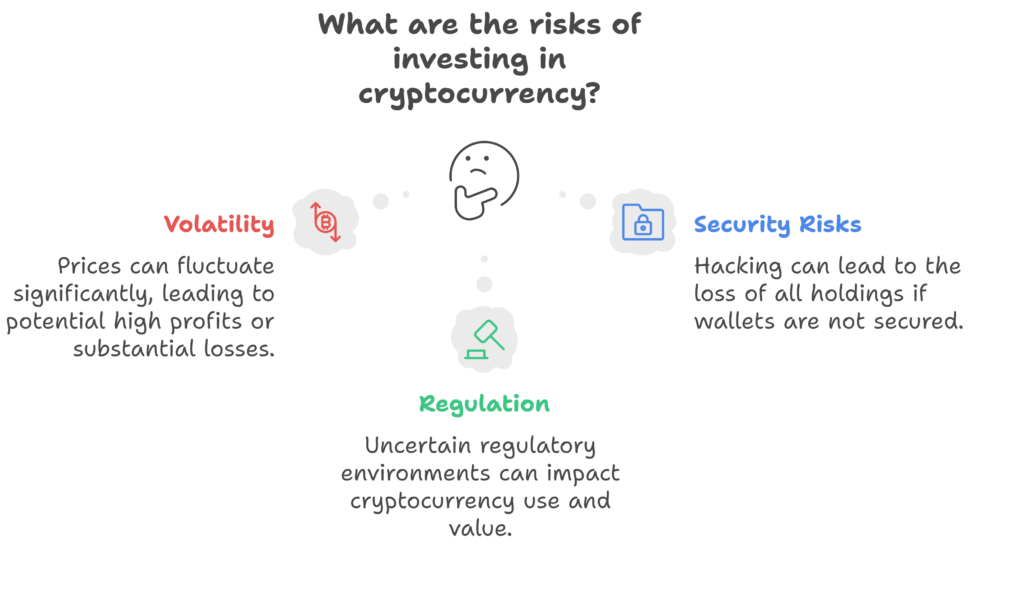

While cryptocurrency offers many opportunities, it also comes with risks. Some of these include:

- Volatility: Cryptocurrency prices can fluctuate wildly. This can lead to high profits, but it also exposes investors to the risk of significant losses.

- Security Risks: If your crypto wallet is hacked, there’s a chance that you could lose all your holdings. This is why securing your wallet and using two-factor authentication is essential.

- Regulation: Cryptocurrencies face regulatory challenges. Many governments are still figuring out how to regulate cryptocurrencies and their use.

Why Use Cryptocurrency?

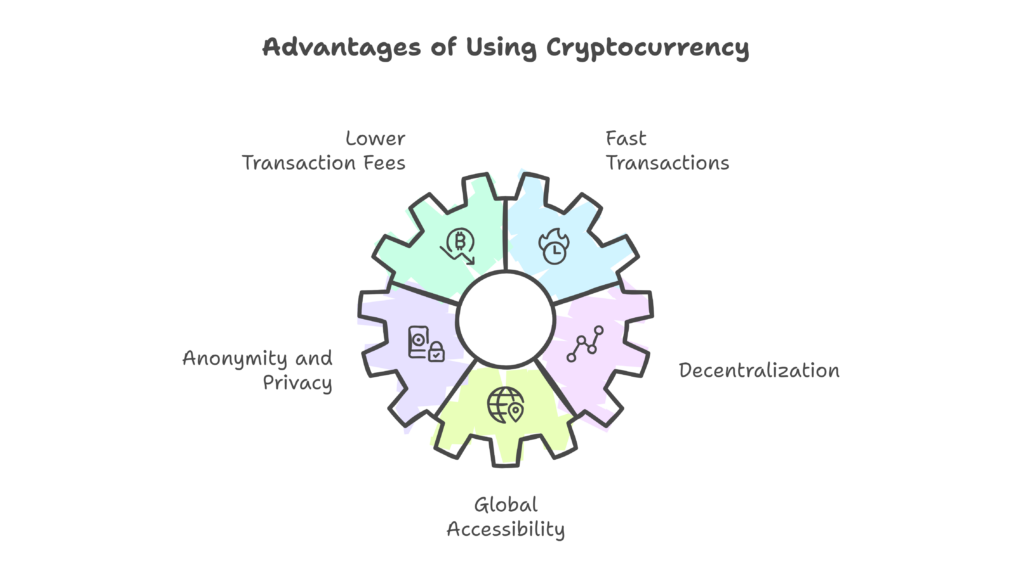

There are many reasons why people choose to use cryptocurrencies:

- Lower Transaction Fees: Cryptocurrency transactions often have lower fees compared to traditional banking and financial services.

- Fast Transactions: Transactions can be processed in minutes, regardless of where you are in the world.

- Anonymity and Privacy: Cryptocurrencies offer a higher level of privacy compared to traditional banking methods. However, some coins like Monero are specifically designed to offer complete anonymity.

- Decentralization: Unlike traditional financial systems, cryptocurrencies operate on decentralized networks, meaning no single authority controls the transactions.

- Global Accessibility: Anyone with an internet connection can use cryptocurrencies, making them an attractive option in countries with unstable economies or limited access to banking services.

The Future of Cryptocurrency

Cryptocurrency is still a relatively new concept, but it is rapidly gaining adoption worldwide. Some see it as the future of finance, while others view it as a speculative asset. Major financial institutions, companies, and even governments are experimenting with cryptocurrencies and blockchain technology.

As regulation improves and more people understand the benefits of digital currencies, cryptocurrencies may become more mainstream, possibly revolutionizing how we store and transfer value.