Discover what is Bitcoin, how it works, and why it’s considered digital gold. Learn about blockchain, mining, and Bitcoin’s impact on the financial world.

In the ever-evolving landscape of digital currencies, Bitcoin has emerged as the undisputed pioneer, revolutionizing the way people perceive money and transactions. Since its inception in 2009 by an anonymous figure known as Satoshi Nakamoto, Bitcoin has grown from a niche project into a globally recognized digital asset. But what exactly is Bitcoin, and how does it work? This article will demystify Bitcoin, explain its underlying technology, and provide insights into its use cases and future potential.

What is Bitcoin?

At its core, Bitcoin is a decentralized digital currency that operates without a central authority or intermediary like a bank. Unlike traditional currencies such as the US Dollar or Euro, Bitcoin exists only in digital form and relies on a technology called blockchain to maintain its ledger and ensure the integrity of transactions.

Bitcoin can be used for various purposes, such as:

- Online purchases

- Investment

- Cross-border transactions

The defining feature of Bitcoin is its scarcity – only 21 million Bitcoins will ever exist, making it resistant to inflation and appealing as a store of value.

How Does Bitcoin Work?

Bitcoin operates on a peer-to-peer network, meaning that transactions occur directly between users without an intermediary. Here’s a step-by-step breakdown of how Bitcoin works:

1. Blockchain Technology

Bitcoin transactions are recorded on a public ledger known as the blockchain. This ledger is maintained by a distributed network of computers (nodes) around the world.

- Each transaction is grouped into a block.

- Blocks are linked together chronologically, forming a chain.

- Once a block is added to the blockchain, it cannot be altered, ensuring transparency and security.

2. Bitcoin Mining

Mining is the process by which new Bitcoins are created and transactions are verified. Miners use specialized hardware to solve complex mathematical problems. When a miner successfully solves a problem, they are rewarded with newly minted Bitcoins.

- Mining ensures that the network remains secure.

- The reward for mining is halved approximately every four years in an event known as the halving.

3. Decentralization

Unlike traditional currencies, Bitcoin is not controlled by a central bank or government. Its decentralized nature means that no single entity can manipulate its value or supply.

4. Bitcoin Transactions

When a user wants to send Bitcoin, they initiate a transaction by specifying the recipient’s address and the amount. The transaction is then broadcast to the network, where miners validate it and add it to the blockchain.

- Transactions are secured using cryptographic keys.

- A private key is required to sign a transaction and prove ownership.

5. Cryptocurrency Wallets

To store and manage Bitcoin, users need a cryptocurrency wallet. There are various types of wallets, including:

- Hot wallets: Connected to the internet (e.g., mobile and web wallets).

- Cold wallets: Offline storage (e.g., hardware wallets like Ledger and Trezor).

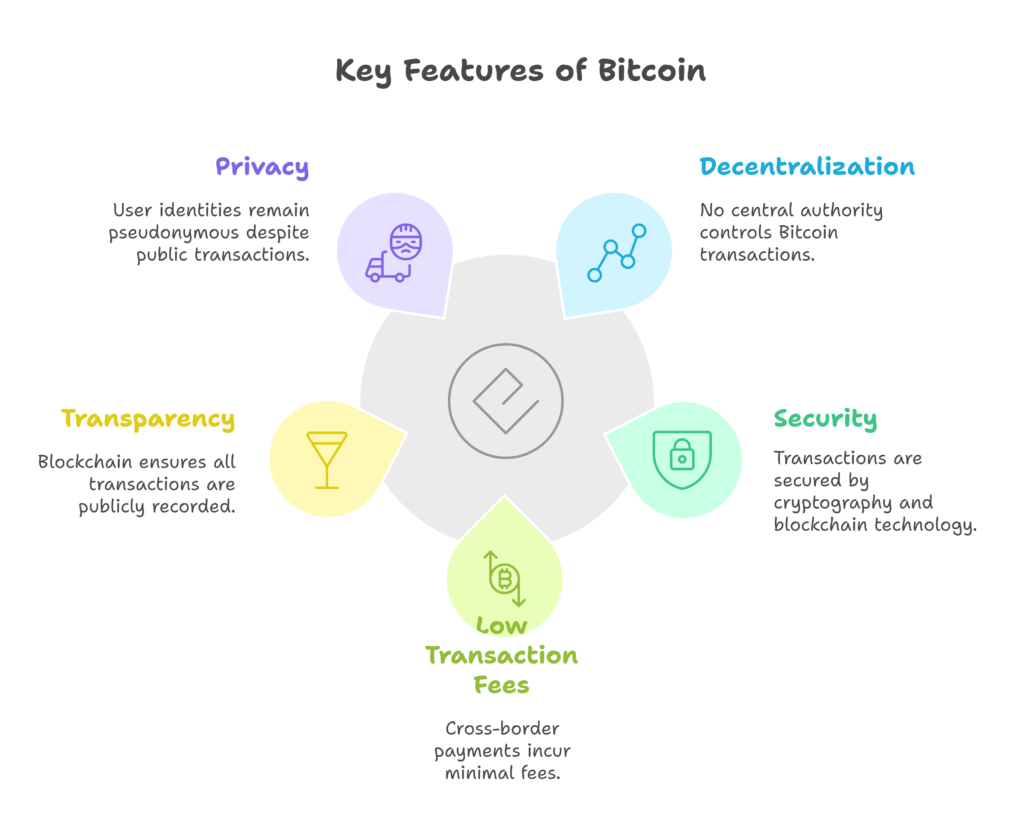

Benefits of Using Bitcoin

- Decentralization: No central authority can control Bitcoin.

- Security: Transactions are secured by cryptography and the blockchain.

- Low Transaction Fees: Cross-border payments can be made with minimal fees.

- Transparency: The blockchain ensures that all transactions are publicly recorded.

- Privacy: While transactions are public, user identities remain pseudonymous.

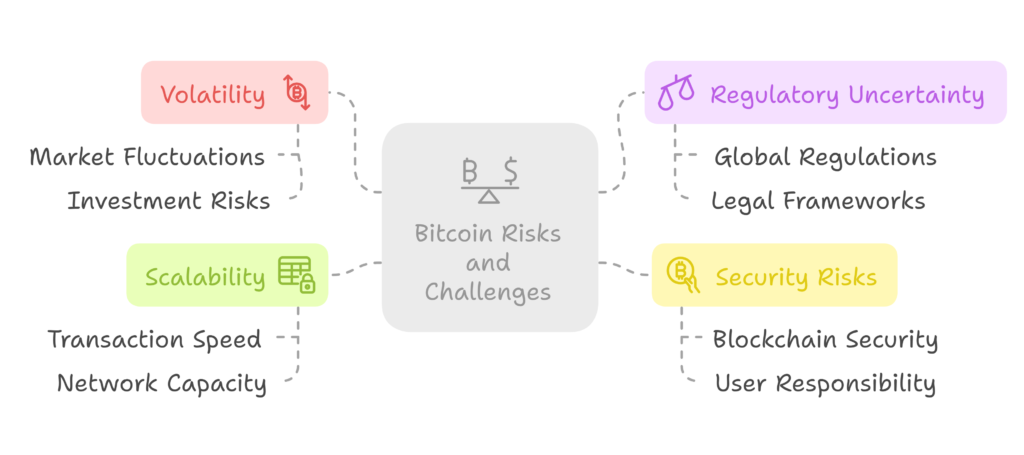

Risks and Challenges

Despite its benefits, Bitcoin comes with certain risks:

- Volatility: Bitcoin prices can fluctuate significantly.

- Regulatory Uncertainty: Governments around the world are still figuring out how to regulate Bitcoin.

- Security Risks: While the blockchain is secure, users must protect their private keys to prevent theft.

- Scalability: The Bitcoin network can handle only a limited number of transactions per second, leading to potential delays.

Use Cases of Bitcoin

1. Digital Payments

Bitcoin enables fast and low-cost digital payments across borders. It is especially useful in countries with unstable currencies or limited access to banking services.

2. Store of Value

Due to its limited supply, Bitcoin is often referred to as digital gold. Many investors view it as a hedge against inflation and economic instability.

3. Remittances

Bitcoin can be used to send remittances internationally without the high fees typically associated with traditional remittance services.

4. Smart Contracts and Layer 2 Solutions

While Bitcoin itself does not support complex smart contracts, second-layer solutions like the Lightning Network enable faster transactions and micro-payments.

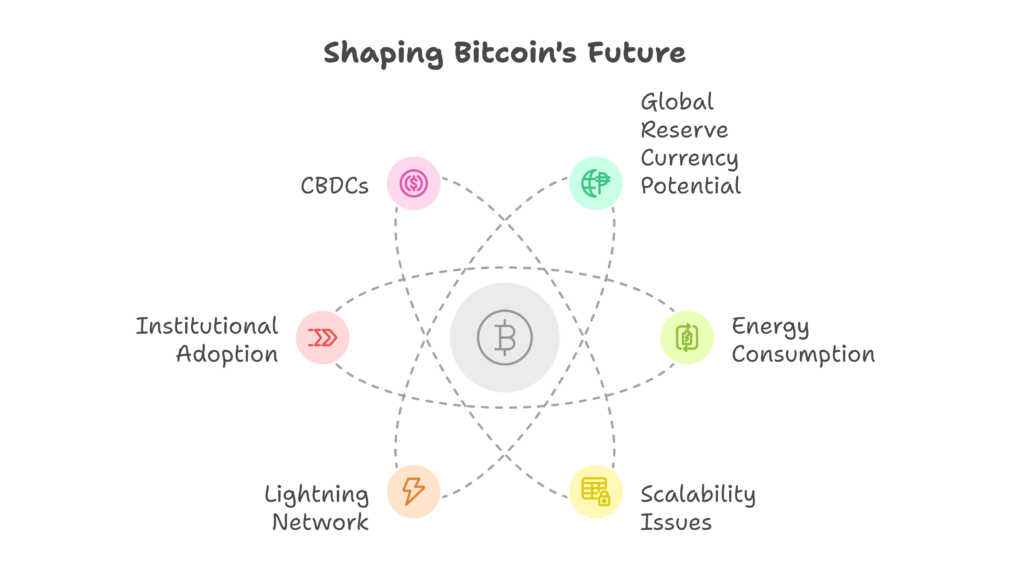

The Future of Bitcoin

Bitcoin’s future is a topic of much debate. Proponents believe it will become a global reserve currency, while critics point to its energy consumption and scalability issues. Innovations such as the Lightning Network and increasing institutional adoption may play a crucial role in shaping Bitcoin’s trajectory.

Additionally, governments and financial institutions are exploring Central Bank Digital Currencies (CBDCs), which could coexist with or compete against Bitcoin.

Final Thoughts

Bitcoin has come a long way since its inception, transforming from an obscure digital experiment into a globally recognized financial asset. By understanding what Bitcoin is and how it works, individuals can make informed decisions about its use and potential as a digital currency. Whether you’re a casual user, an investor, or simply curious, staying informed about Bitcoin and its underlying technology is key to navigating this digital frontier.

FAQs

Q 1. What is Bitcoin?

Bitcoin is a decentralized digital currency that operates without a central authority, enabling peer-to-peer transactions using blockchain technology.

Q 2. Who created Bitcoin?

Bitcoin was created in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto.

Q 3. How does Bitcoin work?

Bitcoin works on a peer-to-peer network where transactions are verified and recorded on a public ledger called the blockchain. Miners validate transactions by solving complex mathematical problems.

Q 4. What is Bitcoin mining?

Mining is the process of verifying Bitcoin transactions and adding them to the blockchain. Miners are rewarded with newly created Bitcoins for their work.

Q 5. What is the maximum supply of Bitcoin?

The maximum supply of Bitcoin is capped at 21 million coins. This limit makes Bitcoin scarce and contributes to its value.

Q 6. How can I buy Bitcoin?

You can buy Bitcoin through cryptocurrency exchanges or peer-to-peer platforms. It’s important to use a secure cryptocurrency wallet to store your Bitcoin.

Q 7. What is a cryptocurrency wallet?

A cryptocurrency wallet is a digital tool used to store, send, and receive Bitcoin. Wallets can be hot (connected to the internet) or cold (offline storage).

Q 8. Is Bitcoin a good investment?

Bitcoin is considered a high-risk investment due to its volatility. Many view it as a store of value or hedge against inflation, but potential investors should do thorough research.

Q 9. Benefits include decentralization, security, low transaction fees, transparency, and privacy in transactions.

Benefits include decentralization, security, low transaction fees, transparency, and privacy in transactions.

Q 10. What are the risks associated with Bitcoin?

Risks include price volatility, regulatory uncertainty, potential loss of funds if private keys are compromised, and scalability issues.

Q 11. How are Bitcoin transactions secured?

Bitcoin transactions are secured using cryptography. Each transaction is signed with a private key, ensuring only the owner of the Bitcoin can authorize spending.

Q 12. What is the blockchain?

The blockchain is a public, decentralized ledger that records all Bitcoin transactions. It ensures transparency and immutability of the data.

Q 13. What are some common use cases of Bitcoin?

Common use cases include digital payments, remittances, investment, and serving as a store of value similar to gold.

Q 14. Can Bitcoin be used for everyday purchases?

Yes, Bitcoin can be used for everyday purchases, though its adoption varies by region. Many online and physical stores accept Bitcoin as payment.

Q 15. What is the Lightning Network?

The Lightning Network is a second-layer solution built on top of Bitcoin that enables faster and cheaper transactions by processing them off-chain.

Q 16. How is Bitcoin different from traditional currencies?

Unlike traditional currencies issued by governments, Bitcoin is decentralized, has a fixed supply, and operates on a transparent public ledger.

Q 17. Is Bitcoin legal?

The legality of Bitcoin varies by country. Some countries fully embrace it, while others have restrictions or outright bans.

Q 18. What is the future of Bitcoin?

The future of Bitcoin depends on various factors, including technological advancements, regulatory developments, and its adoption as a mainstream financial asset.